Top 5 Books to Achieve Financial Freedom

You want to become wealthy? So hear me out - first, you need to learn about money and how it works. Becoming wealthy requires financial education and that means time investment that will pay off in dollar dividends.

Educating yourself about money and/or how to get out of debt can be intimidating, especially if you don't know where to start. Well, don't worry. On my journey for self-education on finances, I have read a lot of books and have narrowed down a top list of the 5 must-reads to learn how to become debt free and wealthy.

These are listed in the order of most fundamental (i.e. basics) to more advanced. Each book can be read individually, but if you're starting from scratch or from a small pool of knowledge, reading them in order will layer your knowledge and help build you up slowly to fully understanding more advanced concepts and how different experts approach them.

If you're not a reader, listen to the audiobook while you're driving, exercising, have some down time, whenever. Mr. Hubs isn't a reader, but he listened to the audiobooks and told me what an impact they made.

Without further ado - here we go! The Top 5 Books to Achieve Financial Freedom!

1. The Fundamentals

The Money Book for the Young, Fabulous & Broke by Suze Orman

Read this if: You need basic, no-nonsense fundamentals; if you're tired of being broke; if you don't know where to start with money.

I, too, laughed when I thought about reading a Suze Orman book. But I gave it a shot, thinking, "What the heck, she's very successful, right?" - and I'm so glad I did. Suze knows what's up and she wants you to know, too.

If you're starting with debt and don't know where to begin or how to fix it, Suze will give you base knowledge, answer common questions about money with straight-forward language, and help you chart a course forward and out of debt.

This book is an excellent foundation for any personal finance education and a great starting point in general - especially if you find money intimidating at all - without going so in-depth that you get lost along the way.

You can get this book on Amazon for $10.63 1 (paperback), $3.84 (audiobook), or $12.99 (Kindle).

2. Deep-Dive Fundamentals

I Will Teach You to be Rich by Ramit Sethi

Read this if: You want deep-dive fundamentals and in-depth finance help; if you want to learn ways to learn how to save money and outsmart the banks.

Ramit Sethi is your man for not just giving you the fundamentals, but explaining the why's of them and giving you great bonus information about investing and money management. This book runs the full financial gamut and his dive into financial experts in general was particularly enlightening, as were his ideas on budgeting and negotiating interest rates.

This book prompted me to actually start asking my bank questions - who finally admitted to me that I was only earning 0.05% interest on my savings account. Yes, you read that right. 0.05%. Let that sink in. It also inspired me to take action on negotiating rates and switch banks to get a better interest rate.

You can get this book on Amazon for $7.20 (paperback), $13.97 (audiobook), or $6.84 (Kindle).

3. Intermediate

The Automatic Millionaire, Expanded and Updated: A Powerful One-Step Plan to Live and Finish Rich by David Bach

Read this if: You are ready to learn how to grow wealthy through hands-off money automation, making your money work for you instead of vice versa.

David Bach is the guy who originated the concept of getting rich by giving up your daily latte, which initially made me hate him when I started reading - but if you make sure to read the Expanded and Updated version, he acknowledges how that one concept blew up, how it was somewhat distorted, and then proceeds to blow your mind with information on the power of your single dollar.

Bach also covers starting to invest for retirement (it's never too late and if you aren't yet, start now - there are no minimums to get started and it's unbelievable how much it pays off), and automating your finances so that you're essentially amassing wealth by default through no real effort of your own. The Expanded and Updated version is crucial for current and incredibly useful information.

The automation spoke to Mr. Hubs and I, and the data on how one dollar can turn into thousands changed my views on spending money in a way that I didn't think was possible. This book so influenced how I view long term investing that halfway through it I increased my company provided retirement percentage and opened a second account with a robo-advisor for Mr. Hubs and I.

You can get this book on Amazon for $9.52 (paperback), $18.53 (audiobook), or $11.99 (Kindle).

4. Advanced Lite

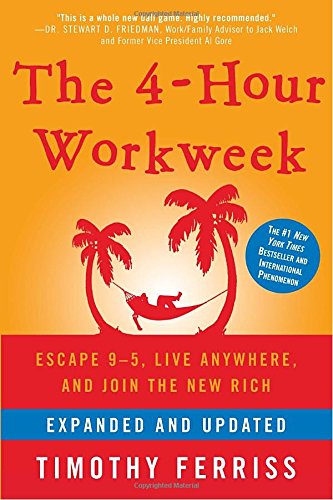

The 4-Hour Workweek: Escape 9-5, Live Anywhere, and Join the New Rich by Timothy Ferriss

Read this if: You're sick of working 40+ hours and need a change; if you want to find out how other 'normal' people succeed on completely different life paths.

Tim Ferriss changed his life to only work 4 hours and he explains to you how he did it. The concepts he introduces are simple, but so out of the ordinary, that it is eye opening and full of great advice and showing what is possible for anyone to accomplish. Thinking about outsourcing, looking at your time as money and how to best utilize it as your greatest asset, and more are included.

This book, more than anything else I have read, is what completely changed how I look at the power of money and the different paths my life could take, solidifying my desire to overhaul our lives financially and break out of the mold we were starting to find ourselves shoved into. I forced Mr. Hubs to listen to the audiobook and neither of us can stop raving about it.

I consider this advanced lite since it is going to create a drive and shift in thinking that extends throughout your life, but in order to fully understand what Ferriss explains, you need a foundation first.

You can get this book on Amazon for $14.40 (hardcover), $18.97 (audiobook) or $12.99 (Kindle).

5. Advanced

Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required by Kristy Shen and Bryce Leung

Read this if: You are ready to move beyond basic finance and break the cycle of being in the "rat race."

This book is more advanced - it covers some basic principles but then goes even deeper into tax havens vs shelters, living off of dividends, and more. If you're big into the FIRE (Financial Independence, Retire Early) movement, I personally think this is a must-read.

You can get this book on Amazon for $12.49 (paperback), $9.99 (Kindle), or $0.99 (audiobook).

Reading these books will be the start of your education in finance. The important thing to remember is that it's never too soon - and it's never too late - to start revolutionizing your money to achieve financial freedom and wealth.

I don't serve ads on this site but I do use affiliate links to help pay for hosting. Please consider helping out by using them. More info here in the disclosure. Cheers!↩